Politicians to focus on food industry in 2014

Iain Ferguson, lead non-executive director at the Department for Environment, Food and Rural Affairs and former ceo of Tate & Lyle, summed up the views of several business leaders who felt the squeeze on take-home pay and, therefore, on living standards would be likely to persist throughout 2014.

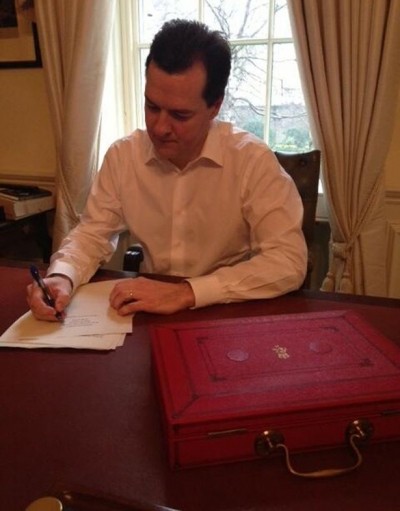

Ferguson, who is also chairman of Wilton Park (a Foreign and Commonwealth Office agency), noted that in the Autumn statement, chancellor George Osborne repeated his number one priority was the reduction of the annual deficit and eventually, post 2020, a start to reducing the national debt.

However, Ferguson added: “In the run up to the May 2015 election, we could see further political forays into the issues of company profitability versus cost-of-living pressures.

‘Defend the voter against big business’

“We have seen Ed Miliband raise the spectre of ‘price-control’ on domestic fuel prices, and while there are all manner of practical issues, it is also clear that a political approach – which seems to ‘defend’ the voter against ‘big business’ – scores well on the door-step. It will be sensible for all major businesses to have thought through how they would respond to [unexpected?] political attention.”

It was a view supported by British Frozen Food Federation director general Brian Young. “My view on the economy is that the slow and steady recovery will continue … Disposable income will continue to be challenged, although, as we approach the next election we may see some sweeteners offered by the government.”

While also cautiously welcoming the “green shoots of recovery”, Food and Drink Federation director Melanie Leech warned: “If consumers’ spending power continues to be diminished then the trading environment will likely be a tough one.”

Leech added: “With the date of the next General Election fixed for May 7 2015, the industry has a great opportunity this year to set out its stall to political parties, explaining what we’ve done to accelerate growth and provide jobs but also how we’ve transformed consumers’ lives.’

‘Political advocates in marginal seats’

“With many of our political advocates in marginal seats, in 2014 we’ll need clearly to make the case for why food and drink, the UK’s largest manufacturing sector is deserving of as much, if not more, support than the sectors that build trains, planes and automobiles.”

Lord Christopher Haskins, claimed the food industry was “much tougher” today than when he chaired Northern Foods (now part of 2 Sisters Food Group). There was intense competition, oversupply, with much less innovation around than before, he said.

“On top of that, structural changes are accelerating, thanks to the internet,” said Haskins. “Manufacturers are being squeezed by buoyant farmgate prices, and shops and supermarkets are under pressure from consumers who feel and are poorer.”

Ferguson also predicted that despite most retailers severely reducing their plans to expand their store footprint and focus instead on “sweating their existing assets”, erosion of in-store sales by internet sales would continue. “In essence, there is now too much retail space for the projected in-store sales and this is likely to lead to sporadic ‘price-wars’ through 2014,” he said.

‘Margin and payment pressure’

The result would be to put the supply chain under “severe margin and payment terms pressure”. He added that there would also be continued pressure for supplier financed promotional support. “We have had relatively benign raw material markets recently, however, looking forward it will be important for suppliers to engage early with retailers as cost pressures start to re-emerge.

“As always, the own-label and perishable product suppliers will face the toughest challenges. 2014 is not going to be an easy year and further consolidation/rationalisation of supply chain operators seems very likely.”

Robert Lawson, a consultant with Food Strategy, which supports food sector businesses in their mergers and acquisitions activity, predicted increasing interest from Asian food groups in UK food manufacturing assets, following their activities in 2013.

Asian interest in UK food

“In 2014 we would expect that trend to continue,” said Lawson, who was formerly a strategy director with United Biscuits, Kraft Foods International and Premier Foods. “Asian food businesses will continue to invest in the UK food sector, seeking quality brands, technologies and management in an investor-friendly environment.”

Lawson suggested the primary challenge for food manufacturers remained how to drive their brands forward while offering consumers good value. “We expect manufacturers to continue to migrate to promoting to a price point rather than to give away volume and, to do that effectively, many will increasingly look to vary pack-weight to maintain or improve profitability.”

Geoff Eaton, former Uniq ceo and for a brief period Premier Foods’ chief operating officer, while slightly more upbeat than Ferguson about the prospects for economic improvement and consumer spending overall noted that the outlook for the food and drink sector was likely to remain tough.

“Consumers are unlikely to lose their habit for bargain hunting,” said Eaton. “Large segments of the population will still be short of money and will look for ways to economise. Price comparison and high levels of price promotion will continue. Innovation will deliver little that is genuinely new and a lot of fast following with brands seeking growth in adjacent sectors.”

Changed shopping behaviour

Eaton added: “The biggest issue will be the competitive pressure exerted by the consumers’ changed behaviours in shopping more frequently in convenience formats, the discounters becoming mainstream and continuing growth in internet shopping.

“The big four will be under pressure to change their infrastructure to respond to this change in consumer behaviour which will exert downward pressure on margins and undermine volumes … Success will come for those that focus on what they do best, drive down costs, invest in true innovation and build brands that consumers trust.”

Read why leading industry figures predicted tougher new food legislation in 2014 here.