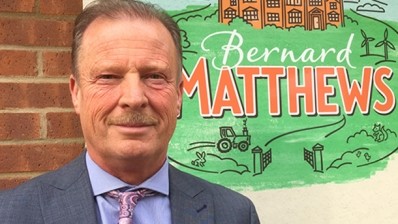

Bernard Matthews seller denies pension claims

Responding to criticism from the influential Work and Pensions Committee, Rutland Partners disputed claims it forced through a pre-pack administration deal with Boparan Private Office, instead of accepting a preliminary buyout offer, which it said were “factually inaccurate”.

A Rutland Partners statement said: “Rutland has a long and established reputation in the UK market for its honesty and integrity, and categorically refutes any suggestion that the outcome of our investment in Bernard Matthews was engineered to ‘line our pockets’, as has been widely suggested in the media.

‘Sought to protect the future’

“At all times Rutland sought to protect the future of the business, those it employed, and including those who had built up defined benefit pensions through their service.”

Rutland Partners’ comments came after the Work and Pensions Committee published letters from the current owner of Bernard Matthews, Boparan Private Office, and administrator Deloitte.

The letters claimed Rutland Partners rejected a buyout offer that would have protected workers’ pension scheme, in favour of an insolvency process, which would have a greater financial benefit for it.

Boparan Private Office chief financial officer Steve Henderson wrote: “In July 2016, Boparan made an offer to buy the whole share capital of Bernard Matthews (which included all assets & liabilities including pension liabilities), but this offer was rejected by the owner Rutland Partners.

‘Why the offer was rejected’

“The offer was sufficient to repay the bank (first charge) and by acquiring the share capital, Boparan would have taken on the pension liability. But, Rutland Partners would not have received full repayment of their loan notes and interest and we assume this latter point is why the offer was rejected.”

Bernard Matthews workers’ pension scheme was transferred from a defined benefit company pension scheme to Pension Protection Fund (PPF) assessment.

Work and Pensions Committee chair Frank Field MP said: “I have confidence that the PPF, working with the scheme trustees, will act in the best interests of the pensioners, but it's clear that the former owners passed up a better deal for pension scheme members in favour of lining their own pockets.”

Bernard Matthews was sold to Boparan Private Office in September. The deal secured the future of 2,000 jobs, it was claimed.

Bernard Matthews sale row – at a glance

- Select committee claimed Rutland Partners was more interested in “lining their own pockets” than workers

- First acquisition offer rejected would have secured workers’ pension schemes

- Second acquisition offer accepted, but pension scheme transferred to PPF

- Rutland Partners refutes claims