Food and drink SMEs wait longer for payment

Food firms with a turnover below £10M are waiting an average of 48 days to receive payment whereas larger businesses with turnover in excess of £500M are paid within 33 days, the report claimed.

Food and drink businesses with a turnover below £1M are waiting an average of 56 days for payment, or an additional three weeks, compared to the bigger businesses.

Payment delays are a deep-seated problem for SMEs in the food and drink sector, ABFA chief executive Jeff Longhurst said.

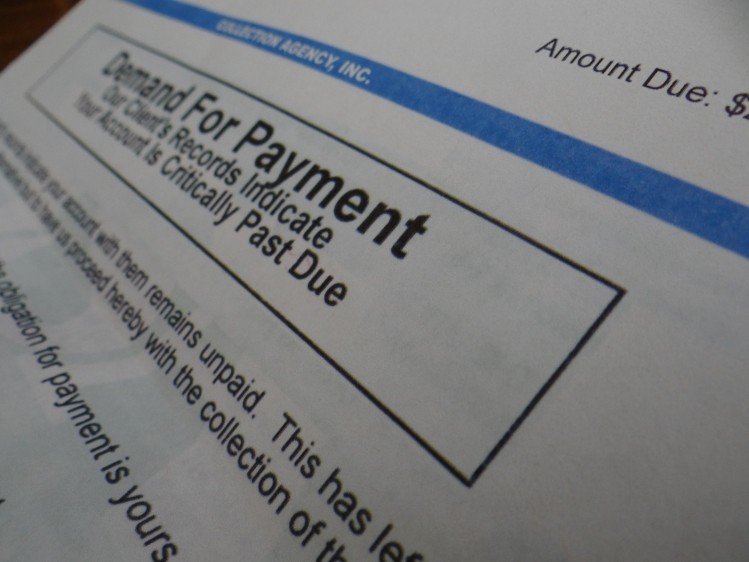

Hit hard

“With competition intensifying in the supermarket sector thanks to the expansion of the German discounters, perhaps that’s no surprise,” he said.

“These extra delays to receive payment hit SMEs particularly hard as they are often relying on this income to pay their own suppliers and it can have repercussions down the supply chain.”

Government intervention to create a fairer waiting time for payments had failed to prevent the suffering, he added.

Its recent Enterprise Bill aims to establish a small business commissioner with the remit of helping SMEs in disputes over issues with larger businesses including by referring SMEs with issues over payment delays to mediation.

“Introducing mediation is a start but it won’t help SMEs with their immediate cash flow problems when payment on an invoice is late,” Longhurst said.

Funding options

Asset-based finance in numbers

- 80% is invoice finance

- 20% is asset-based lending

- £19.3bn asset-based finance paid by ABFA members

- 42,000 SMEs in UK and Ireland use it

Accessing funding through invoice finance is an increasingly popular method of mitigating the impacts of extended payment terms or late payment, the ABFA said.

Invoice finance allows businesses to receive payment up front for their unpaid invoices, ensuring they are protected against unfair payment practices, and letting them invest in their growth.

Longhurst said: “It’s more important than ever that businesses in the food and drink sector fully understand the options available to them to free up the funds they require and to minimise the impact of late payment.”